If The Money Managers and American Debt Folks and the Home Builders and Those Selling Homes and Home Appraisers don’t pay ATTENTION, then America will follow into the same Money Budget Trap that is swallowing our friends, The Canadians. It’s gonna happen here. 🇨🇦 and 🇺🇸 are rapidly gathering to implosion. And what will Happen then? Too many Old are living far past what they planned to live and becoming a burden on their Governments and States.

Canada is indeed facing a severe housing affordability crisis, with home prices and household debt reaching alarming levels. This crisis has been exacerbated by a combination of factors, including low interest rates, high demand, and a limited supply of affordable housing.

According to the Canadian Real Estate Association (CREA), the average national home price in September 2023 was $668,754, up 6.3% from July 2022. This represents a significant increase from just a few years ago, when the average home price was around $500,000.

One of the main drivers of the housing affordability crisis has been the low interest rates that have been in place for several years. These low rates have made it easier for people to borrow money to buy homes, which has fueled demand and driven up prices.

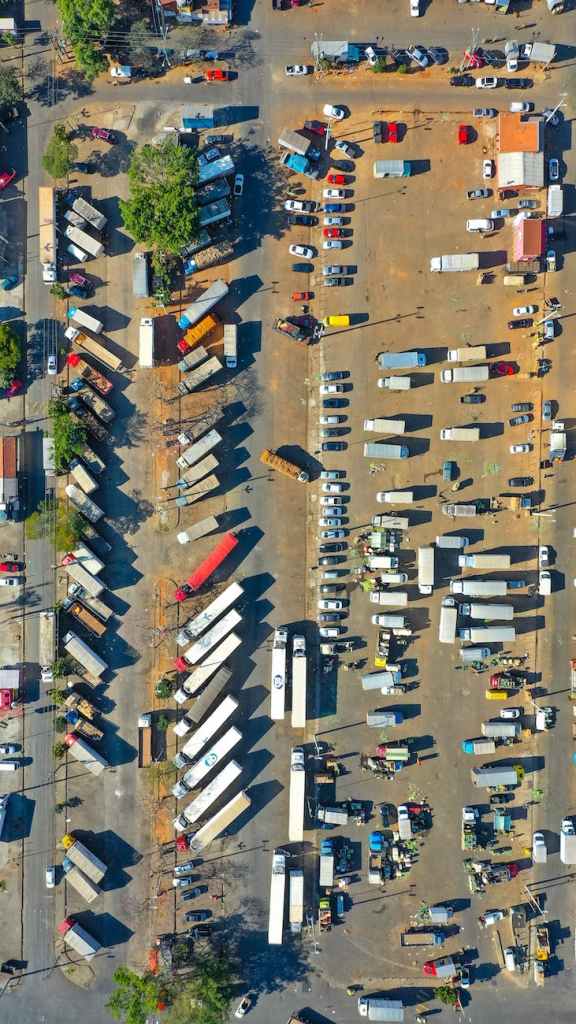

Another factor contributing to the crisis is the high demand for housing. Canada’s population is growing, and there is a strong demand for housing in major cities such as Toronto and Vancouver. This demand is putting upward pressure on prices, making it difficult for people to afford homes.

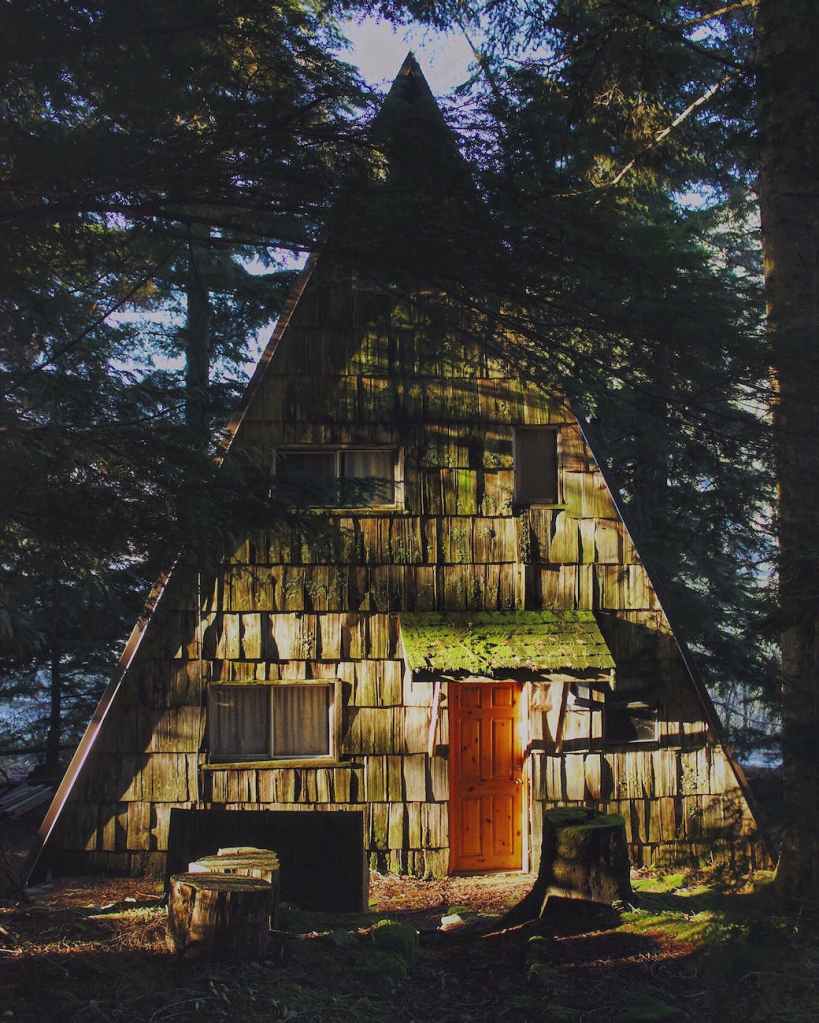

At the same time, there is a limited supply of affordable housing in Canada. This is due to a number of factors, including a lack of land available for development, government regulations that make it difficult to build new homes, and the high cost of construction materials.

The combination of these factors has created a situation where many Canadians are struggling to afford homes. The median household debt-to-income ratio in Canada is now at an all-time high of 180.7%, meaning that Canadian households owe an average of $1.80 for every dollar of income they earn. This high level of debt is making it difficult for many Canadians to save for a down payment on a home, and it is also putting them at risk of financial hardship if interest rates rise.

The housing affordability crisis in Canada is having a significant impact on the lives of Canadians. It is making it difficult for people to afford homes, it is putting a strain on household budgets, and it is contributing to inequality. The government is taking some steps to address the crisis, but more needs to be done to make housing more affordable for Canadians.

Canadian college debt is one of the many factors contributing to the housing affordability crisis in Canada. When individuals have significant student loan debt, it can make it difficult to save for a down payment on a home, qualify for a mortgage, and manage their overall debt load. Americans across America have ignored fixing these exuberant College Debts in America which is causing many other Issues

Saving for a Down Payment:

A down payment is typically a substantial amount of money, often ranging from 5% to 20% of the home’s purchase price. For individuals with student loan debt, allocating funds towards a down payment becomes increasingly challenging. The monthly student loan payments can strain their finances, leaving less room to save for a home.

Qualifying for a Mortgage:

Mortgage lenders consider various factors when assessing a borrower’s eligibility, including their income, debt-to-income (DTI) ratio, and credit score. Student loan debt directly impacts the DTI ratio, which measures the proportion of a borrower’s monthly gross income that goes towards debt repayments. A high DTI ratio can make it difficult to qualify for a mortgage or may lead to higher interest rates.

Managing Overall Debt Load:

College debt adds to an individual’s overall debt burden, making it more challenging to manage their finances and meet all their financial obligations. With student loan payments, mortgage payments, and other expenses, individuals may struggle to make ends meet, increasing the risk of financial hardship.

Impact on Homeownership Rates:

The combination of these factors can significantly hinder individuals’ ability to become homeowners. The rising cost of housing, coupled with the financial constraints imposed by student loan debt, is contributing to a decline in homeownership rates, particularly among younger generations.

In conclusion, college debt exacerbates the housing affordability crisis in Canada by making it harder to save for a down payment, qualify for a mortgage, and manage overall debt. Addressing the student debt crisis is crucial to alleviating the financial burden on individuals and promoting homeownership opportunities.

Debt is gonna cause a Population Drop in Canada and America. And there is no stopping it.

The combination of college debt and home debt can make it difficult for young people to afford other essential expenses, such as having children or owning a car. These financial burdens can delay or even prevent individuals from achieving these life milestones.

Impact on Having Children:

Having children is a significant financial responsibility. The costs associated with raising a child, from childcare to education, can strain household budgets. For individuals with college debt and home debt, these additional expenses can make it difficult to afford the necessary resources for raising a family.

Impact on Owning a Car:

Owning a car is often a necessity for employment, transportation, and overall mobility. However, the costs of purchasing, maintaining, and insuring a car can be prohibitive for individuals with substantial debt. The burden of student loan payments and mortgage payments can make it challenging to afford car payments, fuel, and other car-related expenses.

Delayed Life Milestones:

As a result of these financial constraints, young people may face delayed or postponed life milestones. They may choose to delay having children until their debt is under control or forgo owning a car to prioritize other financial goals. These delays can impact their personal and professional lives, affecting their family planning, career advancement, and overall well-being.

Addressing the Debt Crisis:

Addressing the student debt and housing affordability crises is crucial to improving the financial outlook for young people. Policy measures that reduce student loan burdens, promote affordable housing options, and increase financial literacy can help alleviate the pressure on young individuals and enable them to achieve their aspirations.

Conclusion:

The combination of college debt and home debt can significantly impact young people’s ability to afford essential expenses and achieve life milestones. By addressing these debt crises, we can create a more equitable and opportunity-rich environment for the younger generation.

The population growth rate in the United States and Canada is currently around 0.4%. This means that the population is increasing by about 0.4% each year. This is a relatively slow rate of growth compared to historical levels. For example, the population growth rate in the United States was around 3.5% in the 1950s.

There are a number of reasons why population growth in the United States and Canada has slowed down in recent years. One reason is that the fertility rate, which is the average number of children born to each woman, has declined. In the United States, the fertility rate is now around 1.7, which is below the replacement rate of 2.1. This means that the population is not growing large enough to replace itself.

Another reason for the slowdown in population growth is that immigration levels have also declined. In the United States, for example, net immigration, which is the number of people who immigrate to the country minus the number who emigrate, has fallen in recent years. This is due in part to stricter immigration policies.

The slowdown in population growth has a number of implications. One implication is that the workforce is growing more slowly. This could lead to labor shortages in some industries. Another implication is that the population is aging. This could put a strain on social safety net programs, such as Social Security.

Overall, the slowdown in population growth in the United States and Canada is a significant demographic trend with far-reaching implications. It is important to understand the causes of this trend and to prepare for its consequences.

You must be logged in to post a comment.