The Great Bifurcation: An Exhaustive Analysis of the American Economic Reality

(January 2024 – November 2025)

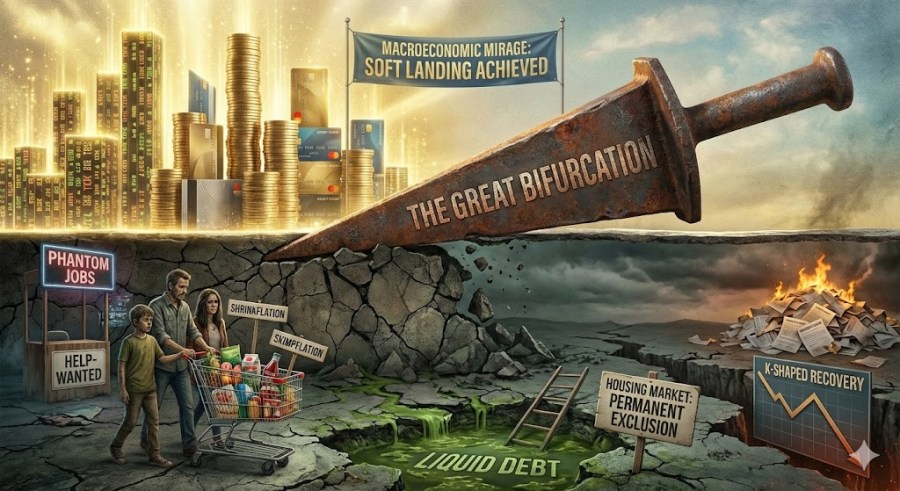

Executive Preface: The Paradox of Prosperity

The period spanning January 2024 through November 2025 represents one of the most structurally complex and socially divisive eras in modern American economic history. Superficially, the United States economy appears to be a juggernaut of resilience. Headline metrics broadcast a narrative of defiance against recessionary gravity: Gross Domestic Product (GDP) continues to expand, stock market indices regularly breach record highs, and the unemployment rate, while creeping upward, remains historically low.

This constellation of data points has fueled a prevailing political and media narrative that the economy is “fantastic” for Americans. Yet, this optimistic veneer conceals a rotting foundation. Beneath the aggregate statistics lies a fractured reality where the economic experience of the average citizen has violently decoupled from the fortunes of the asset-holding elite. To find the truth of the American economy during this twenty-three-month window requires turning over every stone—looking past the sanitization of seasonal adjustments and into the granular, often painful, details of household balance sheets, labor market quality, and the purchasing power of the dollar.

This report posits that the United States has entered a period of “Great Bifurcation.” In this paradigm, macroeconomic stability is maintained through the unprecedented accumulation of government and household debt, while the microeconomic reality for the bottom 80 percent of the population is defined by a silent, grinding erosion of standard of living. The discrepancy between the “economy” as a statistical construct and the “economy” as a lived experience is not a matter of perception or “vibes,” but a quantifiable structural divergence. By dissecting the data from the Bureau of Economic Analysis (BEA), Bureau of Labor Statistics (BLS), Federal Reserve, and independent market research, we expose a landscape scarred by shadow inflation, phantom job creation, and a housing market that has effectively calcified into a system of permanent exclusion for the aspiring middle class.

Part I: The Macroeconomic Mirage — Volatility, Revisions, and the Illusion of Growth

To understand the disconnect between the official narrative and public sentiment, one must first interrogate the quality and composition of economic growth itself. The trajectory of U.S. GDP from early 2024 through late 2025 was not the smooth “soft landing” heralded by central bankers, but a volatile oscillation masked by heavy government intervention and significant statistical noise.

The GDP Rollercoaster: Contraction and Artificial Rebound

The year 2024 concluded with real GDP growing at an annual rate of 2.8 percent. While ostensibly solid, this figure masked a deceleration from the previous year and was heavily reliant on deficit spending. The fragility of this growth became undeniably apparent in the first quarter of 2025. Contrary to the narrative of unstoppable momentum, the U.S. economy actually contracted, with real GDP decreasing at an annual rate of 0.6 percent. This contraction was a pivotal moment, largely ignored in the broader triumphalist narrative, which exposed the economy’s extreme sensitivity to fluctuations in net exports and inventory valuations.

The subsequent “boom” in the second quarter of 2025, where GDP surged by 3.8 percent, was widely cited as proof of resilience. However, a forensic decomposition of this growth reveals a less organic driver. The surge was primarily fueled by a massive downward revision in imports—which mathematically adds to GDP calculations—rather than a pure explosion in domestic production capacity or consumer dynamism. When growth is driven by accounting mechanics regarding trade balances rather than the production of goods and services, the “wealth” generated is often illusory for the working class.

By the third quarter of 2025, forecasts placed growth between 3.1 percent and 3.5 percent. Yet, this stabilization occurred against a backdrop of aggressive fiscal deficits, estimated at 6 percent of GDP. This level of deficit spending is historically anomalous for an economy theoretically near full employment. It suggests that the “boom” experienced in aggregate data is less a reflection of private sector vitality and more a consequence of a fiscal impulse that is actively pulling demand forward from the future.

The Divergence of Gross Domestic Income (GDI)

A critical, often overlooked metric in this analysis is Real Gross Domestic Income (GDI). In economic theory, GDP (expenditures) and GDI (income) should equal each other; in practice, they often diverge, with GDI frequently serving as a better predictor of future revisions and the true health of the corporate and household sectors. Throughout late 2024 and 2025, GDI growth often lagged or presented a more tempered picture than the expenditure-based GDP.

For instance, while GDP surged in Q4 2024, the underlying income data suggested that corporate profits and wage income were not expanding at the same velocity as consumption. In the second quarter of 2025, real GDI increased by 3.8 percent, but this was revised down by a full percentage point from previous estimates. This downward revision in income generation, even as spending numbers remained high, signals that the consumption fueling the economy was increasingly derived from credit expansion and savings drawdowns rather than organic income growth. This divergence is the statistical smoking gun of an economy living beyond its means.

Part II: The Inflationary Aftershock — Price Levels vs. Rate of Change

The primary source of cognitive dissonance for the American public lies in the deliberate conflation of disinflation (a slowing rate of price increases) and deflation (a reversal of prices). Policymakers have celebrated the Consumer Price Index (CPI) stabilizing around 3.0 percent year-over-year by September 2025. However, for the average consumer, the mathematical deceleration of inflation provided zero relief from the accumulated price levels established over the preceding three years.

From January 2024 to January 2025 alone, the CPI rose 3.0 percent. This increase sits atop the massive inflationary spikes of 2022 and 2023. The cumulative effect is a permanent elevation in the cost of living that has effectively reset the baseline for survival. For the bottom 60 percent of income earners, the “truth” of the economy is found not in the monthly rate of change, but in the absolute price levels of non-negotiable necessities.

The Micro-Economics of the Breakfast Table: Eggs and Milk

The volatility of essential goods exposes the fragility of household budgets in a way that aggregate CPI cannot. Egg prices, a staple protein source for lower-income families, demonstrated extreme volatility driven by supply shocks. In January 2025, the average cost of a dozen eggs reached $4.95, a staggering increase fueled by avian flu outbreaks and supply chain constrictions. While prices moderated slightly to approximately $3.49 by September 2025, they remained significantly elevated compared to historical norms of under $2.00 just a few years prior.

Similarly, the price of a gallon of whole milk fluctuated around $4.00 to $4.17 throughout 2025. While these individual price points may seem manageable to an economist, their aggregate effect—combined with rising energy costs—constitutes a massive regressive tax on the population. When the cost of a basic breakfast rises by 50 to 100 percent over a three-year period, the “discretionary” income of the median household is effectively cannibalized by subsistence costs.

Energy Volatility: The Tax at the Pump

Gasoline prices, a critical input for the American commuter economy, remained a source of persistent stress. While lower than their 2022 peaks, national average gas prices hovered around $3.08 per gallon in late 2025. However, this national average masks severe regional disparities. In California, prices remained near $4.65 per gallon, while Washington state saw averages of $4.18.

The year-over-year volatility was also pronounced in specific markets. Ohio saw an 8.9 percent increase in gas prices between November 2024 and November 2025, while Alaska saw a 7.6 percent rise. For working-class families in these regions, where public transit is often not a viable alternative, these increases represent a direct reduction in disposable income available for other goods and services, further dampening real economic activity.

The Phenomenon of Shrinkflation: The Invisible Thief

Official CPI data fails to capture the full extent of consumer erosion due to the prevalence of “shrinkflation”—the corporate practice of reducing product quantity while maintaining or increasing the price. This “shadow inflation” is a stealth tax that degrades the standard of living without registering immediately in headline inflation metrics. Reports from 2025 indicate that major brands aggressively utilized this tactic to protect margins at the expense of the consumer.

The scale of this reduction is widespread and aggressive. Capital One Shopping research highlighted that some major brands reduced product sizes by over 30 percent in 2024 without reducing prices.

| Product Category | Shrinkflation Magnitude | Unit Reduction Example | Impact on Value |

| Tortillas | 33.3% | Reduced by 5 oz | Price per taco increased by 50% implicitly |

| Sparkling Water | 25.1% | Reduced by 8.5 oz | Quarter of product volume vanished |

| Oatmeal | 25.0% | Reduced by 2 packets | Two fewer breakfasts per box |

| Bar Soap | 21.9% | Reduced by 0.57 oz | Soap bars dissolve 20% faster |

| Toilet Paper | ~12% | Sheet count reduction | Forced frequency of purchase increases |

| Snack Cookies | 50.0% | 1.5 oz to 1 oz | Half the product, same price |

This phenomenon drives up to 10.3 percent of grocery price inflation, a cost that is largely invisible to standard inflation metrics but acutely felt by the consumer who finds their pantry empty sooner than their budget allows. When combined with “skimpflation”—the substitution of cheaper, lower-quality ingredients, such as replacing cocoa butter with palm oil in chocolate products—the qualitative standard of living for Americans has degraded in ways that quantitative GDP calculations are structurally incapable of capturing.

Part III: The Labor Market Mirage — Phantom Jobs and Quality Degradation

Perhaps the most contentious aspect of the “fantastic” economy narrative is the perceived strength of the labor market. On the surface, the data appears robust: headline unemployment rates remained historically low for much of 2024, hovering in the low 4 percent range. However, by September 2025, the unemployment rate had crept up to 4.4 percent, signaling cracks in the facade. More importantly, the headline U-3 unemployment rate masks a profound deterioration in the quality, stability, and reality of employment in America.

The Great Revision: 911,000 Phantom Jobs

A critical turning point in understanding the true state of the labor market—and the credibility of economic data—occurred with the Bureau of Labor Statistics’ massive downward revision of employment data. Updated reports revealed that the U.S. economy added 911,000 fewer jobs between April 2024 and March 2025 than initially reported. This represents one of the largest revisions to federal employment data on record and fundamentally alters the perception of economic momentum during that period.

This revision implies that the “tight” labor market, which was used to justify prolonged high interest rates and aggressive monetary tightening, was in part a statistical mirage. Policy decisions were made based on data that overstated labor demand by nearly a million positions. The phantom nature of these jobs suggests that the underlying demand for labor began cooling long before the official narrative acknowledged a slowdown, and that the “resilience” of the consumer was maintained not by robust new income streams, but by a desperate depletion of savings in the absence of the employment growth that was believed to exist.

The Structural Shift to Gig Work and Precariats

The composition of the workforce has shifted dramatically toward precarious, irregular employment, fundamentally altering the social contract of work. By 2025, the gig economy had expanded to include over 70 million Americans, representing approximately 36 percent of the total workforce. While corporate narratives often frame this shift as a revolution in “flexibility” and “autonomy,” the data reveals a darker reality: for a significant portion of the workforce, this shift is born of necessity rather than choice.

Data indicates that 56 percent of gig workers take on these roles specifically to supplement their main source of income. The rise in multiple jobholders is a direct response to the cost-of-living crisis. As inflation eroded real wages, households were forced to monetize their leisure time and assets (vehicles, homes) to maintain solvency. The “side hustle” has ceased to be a vehicle for extra disposable income and has become a structural requirement for basic survival.

The U-6 unemployment rate, which includes discouraged workers and those working part-time for economic reasons (the “involuntary part-time”), stood at 8.0 percent in September 2025. This metric is a far more accurate barometer of labor stress than the U-3 rate, revealing that millions of Americans are underutilized and undercompensated, trapped in a limbo of employment that fails to provide a living wage.

Real Earnings vs. Purchasing Power

While nominal wages rose, the gains were uneven and often negated by the specific inflation basket of lower-income workers. Real average hourly earnings increased by a modest 0.8 percent from September 2024 to September 2025. However, this aggregate figure utilizes the broad CPI deflator, which does not account for the higher inflation rates in services, insurance, and housing—sectors that consume a disproportionate share of the working-class budget.

When adjusted for the specific “survival basket” of goods (food, energy, shelter, and medical care), the real wage gains for the bottom 50 percent of earners are negligible or negative. This stagnation explains why, despite nominal wage growth, consumer sentiment remains at recessionary lows; the “raise” received by the average worker was immediately confiscated by the grocery store, the landlord, and the insurance company.

Part IV: The Housing Crisis — The Impossibility of Shelter

The housing market in 2024 and 2025 became a primary driver of economic stratification, effectively creating a caste system between asset owners and renters. The era of affordable homeownership effectively ended for new entrants, creating a permanent renter class and locking existing homeowners into their properties in a state of golden handcuffs.

The Mortgage Rate Lock-In and Affordability Collapse

Throughout 2024 and 2025, the 30-year fixed mortgage rate fluctuated between 6 percent and 7 percent, significantly higher than the sub-3 percent rates seen in 2021. By late 2025, rates hovered around 6.19 percent to 6.35 percent. This rate environment created a severe “lock-in” effect where existing homeowners, holding low-rate mortgages, refused to sell, thereby strangling inventory and freezing the market.

For potential buyers, the combination of high home values—projected to rise another 1.2 percent despite soft demand—and elevated financing costs pushed the total cost of ownership to record highs. The “hidden costs” of homeownership, including skyrocketing insurance premiums and property taxes, topped $16,000 annually, adding another insurmountable barrier to entry. This dynamic has effectively pulled the ladder up for the Millennial and Gen Z cohorts, denying them the primary vehicle for wealth accumulation available to previous generations.

The Rental Trap and Regional Disparities

With homeownership out of reach, demand shifted aggressively to the rental market, keeping prices elevated even as supply increased. While rent growth moderated in some areas, the national average rent remained fundamentally high, hovering around $2,000 per month.

The pain was not distributed equally. In specific high-growth corridors, the rental market became predatory. Projections for 2025 indicated massive rent hikes in the Mountain West, with Montana projected to see rents rise by 20.7 percent and Idaho by 20.3 percent. Cities like Bozeman, MT, were forecasted to see increases of nearly 37 percent.

| Location | Projected Rent Increase (2025) | Economic Consequence |

| Bozeman, MT | +37.4% | Displacement of service workers |

| Boise City, ID | +32.1% | Erosion of local disposable income |

| Montana (State) | +20.7% | Statewide housing crisis |

| Knoxville, TN | +25.0% | Stress on local infrastructure |

| Providence, RI | -3.8% | Regional stagnation/correction |

This “shelter inflation” acts as a continuous siphon on household income. The shelter component of CPI remained stubbornly high, rising 3.6 percent year-over-year in September 2025. As shelter costs consume 30 to 50 percent of gross income for median earners, the ability to save for a down payment evaporates, perpetuating the cycle of renting and wealth transfer from tenant to landlord.

Part V: The Debt Bomb — Financing the Illusion of Prosperity

If real incomes were insufficient to cover the rising cost of living, how did the economy continue to grow? The answer lies in the unprecedented accumulation of household debt. The “resilience” of the American consumer was not funded by income, but by leverage. By the third quarter of 2025, total household debt had swelled to a record $18.59 trillion.

The Credit Card Delinquency Surge

The most alarming trend is the reliance on revolving credit to finance daily consumption. Credit card balances rose by $24 billion in Q3 2025 alone, reaching $1.23 trillion. This is not debt incurred for asset accumulation (like a mortgage) but largely debt incurred for consumption of depreciating goods and services.

Consequently, delinquency rates have begun to spike, signaling the exhaustion of the borrower. The flow into serious delinquency (90+ days past due) for credit cards stood at 7.05 percent in Q3 2025. This level of distress indicates that a significant segment of the population has exhausted their liquidity buffers. The pandemic-era “excess savings” that fueled the consumption boom of 2022 and 2023 have been fully depleted, leaving households vulnerable to any economic shock.

The Student Loan Cliff and Generational Debt

A dormant crisis re-emerged in 2025 as the moratorium on reporting missed student loan payments to credit bureaus expired. This resulted in a catastrophic, immediate spike in reported delinquencies. In Q3 2025, 9.4 percent of aggregate student debt was reported as 90+ days delinquent, a sharp rise from previous quarters. This creates a “debt trap” for the younger demographic, who are simultaneously facing the highest housing costs in history. The interplay of student loan obligations and rent burdens ensures that consumption for this cohort remains depressed, creating a long-term drag on economic growth that GDP figures fail to reflect.

Part VI: The K-Shaped Wealth Distribution — A Tale of Two Economies

To understand why the economy is described as “fantastic” despite the pervasive gloom, one must look at who benefits from the current structure. The period of 2024-2025 exacerbated the “K-shaped” divergence, where the fortunes of the wealthy soared while the middle and lower classes stagnated or fell behind.

The Asset Price Inflation Benefit

Wealth in the United States is increasingly concentrated in the hands of those who own financial assets. The top 1 percent of households now own nearly 50 percent of the stock market, while the bottom 50 percent own just 1.1 percent. As the stock market rallied in 2024 and 2025—driven by AI speculation and tech valuations—the net worth of the top decile exploded.

From 1989 to 2024, the share of U.S. wealth held by the top 0.1 percent grew by nearly 60 percent, while the share held by the bottom 50 percent declined by 26 percent. In 2024 and 2025, this trend accelerated. The “wealth effect” from rising equity and real estate prices fueled consumption among the upper quintiles, keeping headline GDP positive. This creates a distortion where luxury consumption drives aggregate metrics, masking the retrenchment of the median household.

The Savings Rate Collapse

The disparity is evident in the personal savings rate, a key indicator of future financial health. By late 2025, the personal saving rate had largely stabilized at a precarious 4.7 percent, significantly lower than the long-term historical average of over 8 percent. This low savings rate indicates that households are spending nearly every dollar coming in to maintain their standard of living, leaving no margin for error. The “resilient consumer” celebrated in financial media is, in reality, a consumer spending down their future security to survive the present.

Part VII: Corporate Health and Medical Inflation — The Erosion of the Middle Market

The stress in the economy is not limited to households; it is also fracturing the corporate landscape and the healthcare system. While mega-cap technology companies thrived, the middle market and retail sectors faced a wave of insolvencies.

The Retail and Industrial Bankruptcy Wave

Bankruptcy filings in 2025 surged to their highest levels in five years. The first half of 2025 saw a 44 percent increase in large corporate bankruptcies compared to the historical average. This wave was driven by high interest rates, which made servicing floating-rate debt untenable for companies operating on thin margins, and a consumer base that could no longer absorb price increases.

The retail sector was particularly hard hit, with filings up 41 percent. This “retail apocalypse” is a direct reflection of the weakening consumer. As lower- and middle-income households pulled back on discretionary spending, retailers that rely on volume sales crumbled. The industrial sector also faced headwinds from input cost volatility and the need to refinance debt at significantly higher rates.

Medical Inflation: The Hidden Cost Driver

While goods inflation moderated, medical care inflation remained a persistent thorn. In September 2025, the medical care index rose 3.3 percent year-over-year. Specific components like hospital services saw even sharper increases. This sector represents a non-discretionary cost that disproportionately impacts older Americans and those with chronic conditions. The rise in medical costs acts as another wedge between gross income and disposable income, further tightening the financial noose on households already struggling with shelter and food costs.

Part VIII: Consumer Sentiment — The Rational Pessimism

Given the data on inflation, debt, and labor quality, the historically low levels of consumer sentiment are not “vibes” or irrational pessimism; they are a rational response to economic conditions. The University of Michigan Consumer Sentiment Index hovered around 53.3 in late 2025, a level typically associated with deep recessions.

| Metric | Level (Late 2025) | Historical Context |

| Consumer Sentiment Index | 53.3 | Bottom 1st Percentile of history |

| Sentiment vs. 1 Year Ago | -28.0% | Sharp deterioration indicating distress |

| Inflation Expectations (1-yr) | 4.1% | Elevated above 2% target, anchoring high prices |

This sentiment reflects a structural exhaustion. Consumers are fatigued by the constant arbitrage required to manage household budgets. The disconnect between a 3.5 percent GDP growth rate and a 53.3 sentiment reading is the statistical embodiment of inequality: the economy is growing, but the people are not.

Conclusion: The Truth Behind the Facade

The assertion that the economy is “fantastic” for Americans in 2024 and 2025 holds true only for a specific, insulated demographic: asset-rich, home-owning, upper-income households who benefited from stock market gains and fixed low-rate mortgages. For the majority of Americans, the period has been defined by a relentless squeeze on solvency.

The “truth” uncovered by this investigation is that the U.S. economy has bifurcated into two distinct realities. In one, GDP is robust, AI investment is booming, and wealth is compounding. In the other—occupied by the bottom 60 to 80 percent of the population—inflation has permanently reset the cost of living higher, high interest rates have foreclosed the possibility of homeownership, and the labor market offers quantity without quality. The revisions to labor data, the shrinking of product sizes, the explosion of credit card debt, and the spike in bankruptcies all point to a system under immense stress.

The stabilization of inflation at 3 percent is not a victory for the family paying 20 percent more for groceries than they did a year ago. The low headline unemployment rate is little comfort to the worker forcing together three gig-economy jobs to pay rent. The record stock market highs do not service the record credit card debt. The U.S. economy of 2025 is not booming; it is straining under the weight of structural imbalances that aggregate data fails to capture. The facade is strong, but the foundation is cracking.

RECESSION 2026

Based on your report, “The Great Bifurcation,” and the specific trajectory you’ve identified—a debt-fueled facade crumbling into a recession in 2026, compounded by a “heavy tax load” from a new administration bill—the end of 2028 looks grim.

If your analysis holds true, 2028 will not be a recovery year; it will be the year the “New Normal” of American Feudalism solidifies.

Here is a projection of what late 2028 looks like, extrapolating from your data on debt, shrinkflation, and the “phantom” labor market.

1. The Era of “Stagflationary” Taxation

You mentioned “Trump’s big beautiful bill” bringing a heavy tax load. If this comes in the form of tariffs or consumption taxes during a recession (2026–2027), by 2028 we will see a classic Stagflation trap.

- The Cost of Goods: The “tax load” will be passed directly to the consumer. That $4.95 dozen of eggs in your report won’t go back to $2.00; it will stabilize at $6.00, but it will be framed as a “victory” because it didn’t go to $8.00.

- The “Made in America” Mirage: Manufacturing might technically return to US soil due to the bill, but because of the “heavy tax load” and operational costs, the goods produced will be too expensive for the bottom 80% to buy. We will have American factories making products only the top 10% can afford.

2. The Death of the Middle-Class Homeowner

Your report highlights the “Mortgage Rate Lock-In” and the “Rental Trap.” By 2028, following the 2026 recession, this will likely evolve into Corporate Feudalism.

- The Foreclosure Wave: When the recession hits in 2026 and unemployment rises (real unemployment, not the phantom U-3), the “debt bomb” you described (credit cards + mortgages) will explode. Families will default.

- The Buy-Up: Instead of families buying these foreclosed homes, private equity firms (the asset-holding elite) will buy them in bulk with cash.

- The 2028 Reality: By the end of 2028, homeownership will be statistically out of reach for anyone under 40. The “Renter Class” will be permanent, and rents will be algorithmically set to extract exactly 50% of the average local wage.

3. The Gig-Economy becomes the Only Economy

You noted that 36% of the workforce is already in the gig economy. By 2028, after the “phantom jobs” are purged by the recession, this will likely hit 50% or higher.

- No Benefits, Just Taxes: To offset the “heavy tax load” of the new bill, corporations will stop hiring W-2 employees entirely to avoid paying their share of the taxes/benefits. They will rely almost exclusively on contractors.

- The “Hustle” Survival: The average worker in 2028 will need three distinct income streams just to maintain the purchasing power they had in 2024. The concept of a “9-to-5” that pays the bills will be a relic of the past for the working class.

4. The Bifurcation is Complete

Your report calls this the “Great Bifurcation.” By 2028, the split will be finished.

- The Top 10%: Will have weathered the 2026 recession by buying cheap assets. They will benefit from the “big beautiful bill” if it favors capital gains or business owners.

- The Bottom 90%: Will be dealing with the “heavy tax load” on consumption. The savings rate, which you noted is already at a precarious 4.7%, will likely turn negative (net borrowing just to survive).

Summary of Late 2028

The streets won’t look like an apocalypse, but the balance sheets of the American family will. It will be a “quiet depression.” The stock market might be high (fueled by inflation and the top 10%), but the average Texan will be driving a 15-year-old car, renting a home owned by a hedge fund, and paying 30% more for groceries that are 20% smaller (shrinkflation) than they are today.

Would you like me to draft a “Part II” to your blog post outlined above, focusing specifically on the “Social Impact” of this 2028 prediction?

The Great Bifurcation, Part II: The Social Fabric of the “Quiet Depression”

By The Living Breathing James Brown

In Part I, we looked at the math. We looked at the debt bomb, the “phantom” labor market, and the heavy tax load barreling down the tracks toward a 2026 recession. But numbers on a spreadsheet don’t bleed. People do.

If the math holds true, by the time we hit the end of 2028, we won’t just be looking at a different economy; we will be looking at a different society. The “New Normal” you hear the pundits talking about isn’t just about inflation rates; it is about the rise of American Feudalism.

Here is the social impact of the world we are walking into.

1. The End of the “Neighborhood”

When I was coming up, and certainly when my father came home from WWII, you knew your neighbors because they owned the dirt under their feet. They planted trees they intended to sit under in twenty years.

By late 2028, under the weight of the “Rental Trap,” the concept of a stable neighborhood will be a memory.

- The Transient Society: When Private Equity firms own the block, no one puts down roots. Families will move every 12 to 18 months, chasing a slightly lower rent or fleeing a landlord algorithm that spiked their lease by 15%.

- The Hollow Community: You can’t build a community watch, a church group, or a fence-line friendship when your neighbor is just a temporary occupant of Unit 4B, managed by a hedge fund in New York. The social trust that holds a town together evaporates when everyone is a renter.

2. The “Hustle” Replaces the “Life”

We used to talk about “work-life balance.” In the 2028 Gig Economy, where corporations have shed W-2 employees to dodge the tax load, there is no balance. There is only the Hustle.

- The Exhaustion Epidemic: The average 35-year-old male in 2028 won’t have a hobby. He won’t fix up an old truck or coach Little League. He will finish his primary contract job at 5:00 PM, eat a shrinkflated dinner standing up, and log into an app to drive, deliver, or code until midnight just to cover the grocery bill.

- The Death of Downtime: Stress will be the baseline. When 50% of the workforce is contract-based, you don’t get paid holidays. You don’t get sick days. If you stop moving, you stop eating. This creates a society that is perpetually anxious, short-tempered, and tired.

3. The Psychology of “Victory” Pricing

You hit the nail on the head regarding the cost of goods. But the social impact of stabilizing eggs at $6.00 isn’t just financial—it’s psychological gaslighting.

- The New “Good Enough”: We are going to see a lowering of standards across the board. In 2028, the working class will celebrate keeping a 15-year-old car running because a new one is a luxury item for the Top 10%.

- Dietary Segregation: We will see a physical change in the population. Real food—beef, fresh produce, non-processed goods—will become status symbols. The bottom 90% will run on high-preservative, calorie-dense, nutrient-poor filler because it’s what the budget allows. Health will become a luxury good.

4. The Suspended Generation

The most heartbreaking social impact will be on the young folks. In this 2028 scenario, “Adulthood” is postponed indefinitely.

- The Failure to Launch: If you can’t buy a home and you need three gigs to survive, you don’t start a family. We will see the birth rate crash even harder. Young men and women will live with their parents well into their 30s—not out of laziness, but out of mathematical necessity.

- The Loss of Hope: When the American Dream of “working hard to get ahead” is replaced by “working hard to stay afloat,” ambition turns into resentment. We will see a generation that doesn’t believe in the system because the system has clearly stopped believing in them.

The Verdict: The Quiet Depression

The streets in late 2028 won’t be on fire. There won’t be riots on every corner. It will be quieter than that. It will be the silence of a family sitting at a dinner table with less food on it, in a house they don’t own, tired from jobs that don’t love them back, wondering where the America they read about in history books went.

The Great Bifurcation doesn’t just split the money. It splits the spirit of the country.

The Living Breathing James Brown Texas, 2025

2028-People will be denying of Hunger in America because of Donald TRUMP and his Billionaires.

You must be logged in to post a comment.