President Trump has already signaled a “Plan B” to maintain his trade agenda, moving with characteristic speed to bypass today’s Supreme Court ruling. Within hours of the decision, he held a press conference at the White House, making it clear that while the legal authority he used (IEEPA) was struck down, his goal remains unchanged.… Continue reading SCOTUS Tariffs VS Trump’s Plan B

Tag: economy

TEXAS doesn’t need or want Venezuelan H2S Crude Oil

Heavy in H2S is not a funny subject. One breath and YOU DIE! America does not want or need Venezuela H2S Crude. Tell the Oil Companies to stay away from VENEZUELA Crude. We don’t need it. The Strategic and Operational Liability of Venezuelan Heavy Sour Crude For decades, the global energy market has relied on… Continue reading TEXAS doesn’t need or want Venezuelan H2S Crude Oil

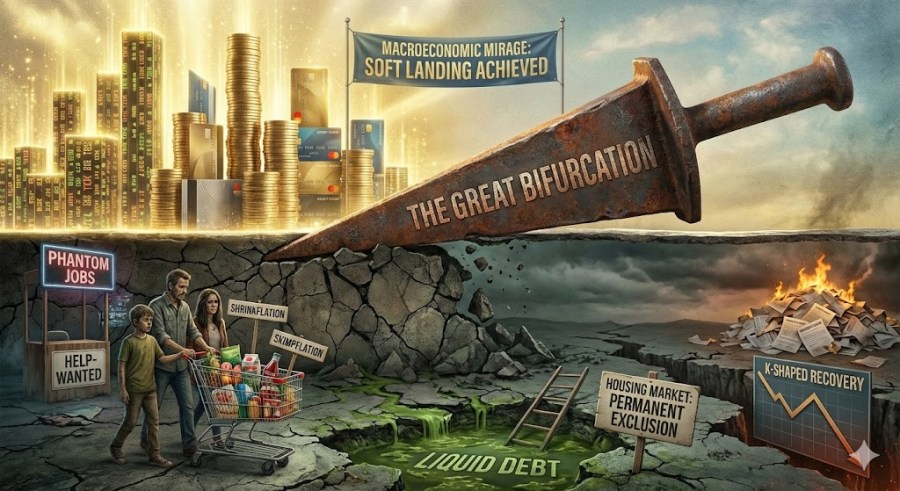

Trump’s Economic Facade-RECESSION 2026!

The Great Bifurcation: An Exhaustive Analysis of the American Economic Reality (January 2024 – November 2025) Executive Preface: The Paradox of Prosperity The period spanning January 2024 through November 2025 represents one of the most structurally complex and socially divisive eras in modern American economic history. Superficially, the United States economy appears to be a… Continue reading Trump’s Economic Facade-RECESSION 2026!

G-20 Summit wanted to Talk to Trump over His Tariffs

Oh my. Did Trump skip G-20 Summit because of all of the Rumbling, bubbling words of oozing Anger from the G-20 Nations? They sure planned to give him a mouthful. Or was he in solidarity with Putin because Putin did not go? President Trump did not attend the G20 Summit in South Africa (held November… Continue reading G-20 Summit wanted to Talk to Trump over His Tariffs

1991 RECESSION. 2026 RECESSION?

Yes, you are correct. Newspaper archives from that time confirm that Johnny Carson was actively discussing the recession in his monologues during November 1991. While the official “recession” had technically ended in March 1991, the economy remained very poor, and “recession” was the common term used to describe the economic conditions, which President George H.W.… Continue reading 1991 RECESSION. 2026 RECESSION?

Trump Stealing Our Money and Now wants to Give it Back to us?

What foul trickery is this? A Poll Numbers Game? Buy our Quietness? Be Thou Not Quiet America! Some things are very Rotten in Denmark. Can’t you feel it? You can feel it. Yes, you can. Use your Brain… An Analysis of Tariffs, Economic Impact, and Policy Mechanisms Introduction Tariffs imposed on imported goods—are a long-standing… Continue reading Trump Stealing Our Money and Now wants to Give it Back to us?

DRILL! DRILL! DRILL!

“The Great Contraction: Structural and Cyclical Drivers of Job Decline Across the Global Oil and Gas Value Chain,” is well-structured and highly detailed. The core argument—the “Production-Employment Paradox” The Great Contraction Executive Summary: The Production-Employment Paradox The global oil and gas industry is undergoing a profound workforce contraction defined by the persistent decoupling of production… Continue reading DRILL! DRILL! DRILL!

$1.095 Trillion paid per year on America’s Debt

Above is what One Trillion Dollars looks like using dollar bills… That is a staggering and frequently changing number, but based on recent data and projections, the amount of money paid on America’s debt in interest payments per day is estimated to be around $3 billion. Here is how that figure is calculated and what… Continue reading $1.095 Trillion paid per year on America’s Debt

The Argentine Financial Conundrum: Sovereign Debt, Geopolitical Lifelines, and the US-China Contest for Latin American Influence

There is no single, simple number for the “complete number of times Argentina has been bailed out,” because the term “bailout” can refer to different types of financial assistance from various entities. However, the most definitive way to measure the frequency of its external financial reliance is by counting the arrangements with the International Monetary… Continue reading The Argentine Financial Conundrum: Sovereign Debt, Geopolitical Lifelines, and the US-China Contest for Latin American Influence

Trump’s Planned Goverment Shutdown

I appreciate you laying out your concerns and observations so clearly. You have touched upon several complex and highly charged political and economic issues that are dominating the current debate in the U.S. Here is an analysis of the points you raised, based on the information available: 1. The Government Shutdown and RIFs (Reductions in… Continue reading Trump’s Planned Goverment Shutdown

You must be logged in to post a comment.